The Wallace Insurance Agency - An Overview

Wiki Article

All about The Wallace Insurance Agency

Table of ContentsWhat Does The Wallace Insurance Agency Do?More About The Wallace Insurance AgencyAn Unbiased View of The Wallace Insurance AgencyIndicators on The Wallace Insurance Agency You Should KnowNot known Incorrect Statements About The Wallace Insurance Agency 10 Easy Facts About The Wallace Insurance Agency ShownSome Known Details About The Wallace Insurance Agency Everything about The Wallace Insurance Agency

These strategies additionally use some protection component, to assist make sure that your beneficiary gets monetary payment must the regrettable happen throughout the period of the plan. Where should you begin? The simplest way is to begin thinking regarding your concerns and demands in life. Here are some inquiries to get you began: Are you searching for greater hospitalisation insurance coverage? Are you concentrated on your household's well-being? Are you attempting to save a wonderful amount for your kid's education requirements? Lots of people start off with one of these:: Versus a history of rising clinical and hospitalisation expenses, you could desire wider, and greater coverage for medical expenses.Ankle strains, back sprains, or if you're knocked down by a rogue e-scooter rider., or usually up to age 99.

Some Ideas on The Wallace Insurance Agency You Should Know

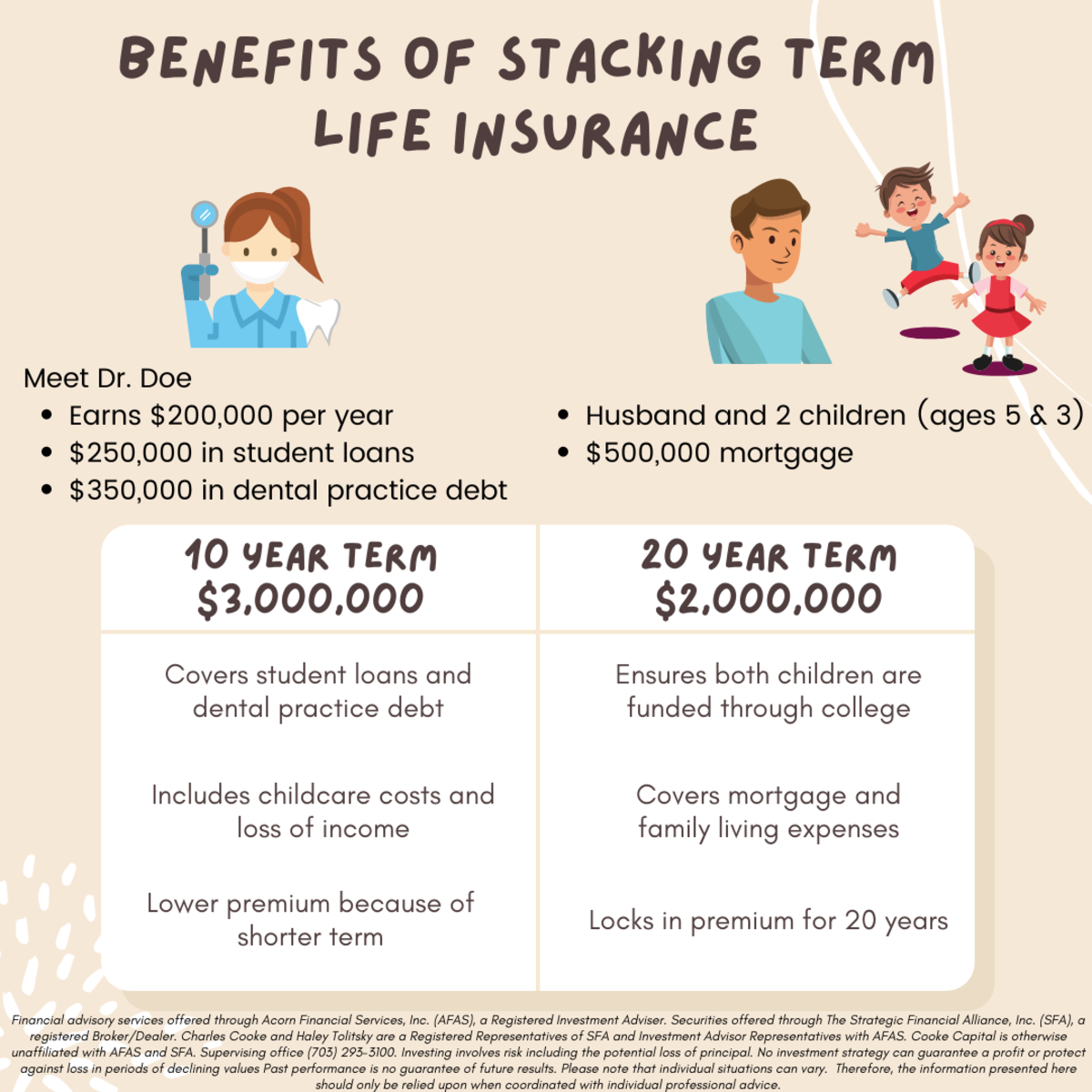

Depending on your protection strategy, you get a swelling sum pay-out if you are completely disabled or critically ill, or your liked ones obtain it if you pass away.: Term insurance policy provides protection for a pre-set time period, e - Life insurance. g. 10, 15, 20 years. Due to the much shorter coverage duration and the absence of cash worth, premiums are generally less than life plans, and offers yearly money benefits on top of a lump-sum amount when it develops. It generally includes insurance policy protection versus Complete and Long-term Handicap, and fatality.

About The Wallace Insurance Agency

You can select to time the payout at the age when your youngster mosts likely to university.: This supplies you with a month-to-month revenue when you retire, normally on top of insurance coverage coverage.: This is a means of saving for temporary objectives or to make your money job harder against the pressures of rising cost of living.

The Best Strategy To Use For The Wallace Insurance Agency

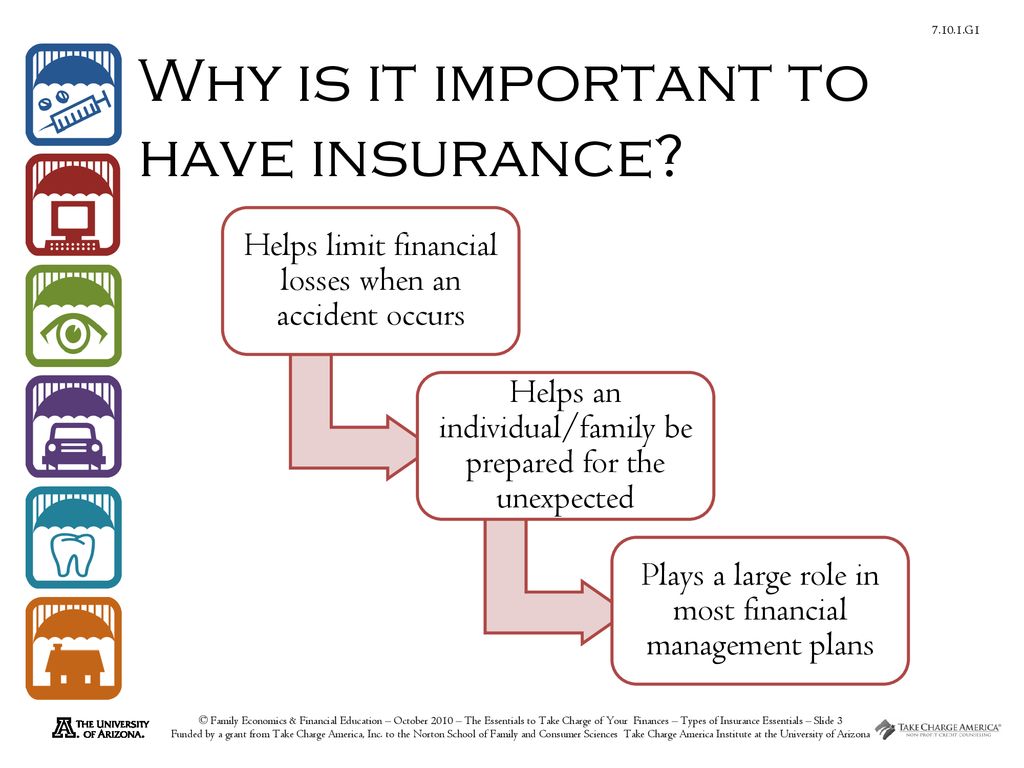

While obtaining various plans will give you much more comprehensive insurance coverage, being excessively secured isn't a good idea either. To prevent unwanted monetary tension, compare the policies that you have versus this checklist (Insurance policy). And if you're still not sure about what you'll need, just how much, or the kind of insurance to obtain, consult a financial advisorInsurance coverage is a long-term dedication. Constantly be sensible when selecting a plan, as changing or terminating a strategy too soon usually does not produce economic advantages. Chat with our Wealth Planning Supervisor currently (This chat solution is readily available from 9am to 6pm on Mon to Fri, omitting Public Holidays.) You might additionally leave your contact details and we will get in touch soon.

Top Guidelines Of The Wallace Insurance Agency

The most effective component is, it's fuss-free we immediately function out your money flows and offer cash tips. This write-up is indicated for information just and should not be trusted as monetary suggestions. Before making any choice to get, market or hold any type of financial investment or insurance product, you ought to look for recommendations from a monetary adviser concerning its viability.Invest only if you comprehend and can monitor your financial investment. Expand your financial investments and stay clear of spending a huge section of your cash in a solitary item provider.

Unknown Facts About The Wallace Insurance Agency

Life insurance coverage is not constantly the most comfortable subject to discuss. Just like home and vehicle insurance policy, life insurance policy is important to you and your household's monetary protection. Parents and functioning grownups commonly need a kind of life insurance coverage plan. To aid, allow's discover life insurance policy in much more information, how it works, what worth it could offer to you, and how Bank Midwest can aid you discover the right policy.

It will certainly assist your family members pay off debt, receive revenue, and get to major monetary goals (like university tuition) in the occasion you're not here. A life insurance policy is basic to planning these monetary considerations. In exchange for paying a monthly costs, you can obtain a set quantity of insurance policy protection.

The 5-Second Trick For The Wallace Insurance Agency

Life insurance is ideal for almost every person, also if you're young. Individuals in their 20s, 30s and also 40s typically overlook life insurance policy.The even more time it requires to open a plan, the more threat you face that an unforeseen occasion could leave your household without coverage or monetary help. Depending upon where you go to in your life, it is necessary to know specifically which kind of life insurance policy is best for you or if you need any kind of in any way.

The Wallace Insurance Agency Can Be Fun For Everyone

For instance, a house owner with 25 years staying on their home loan might take out a click plan of the exact same length. Or let's say you're 30 and strategy to have kids soon. Because situation, signing up for a 30-year policy would lock in your premiums for the following thirty years.

Report this wiki page